Which Type Of Bank Account Typically Offers The Least (If Any) Interest?

As you check out the accounts available, you start wondering: which one doesn’t usually give much interest, if any at all? It’s a common question when we’re deciding how to manage our money, wanting not just convenience but also a chance to make our savings grow.

Think of a checking account as a tool for everyday money tasks. It’s mostly for things like paying bills and buying stuff, not really for saving up money. Because of this, lots of checking accounts don’t give you any extra money (interest) for keeping your cash there.

In this article, we’ll dive into the world of banking to find out which types of accounts don’t give you much interest.

Types Of Bank Accounts:

- Checking Accounts: Designed for everyday transactions, such as depositing paychecks and making purchases. Usually, do not offer interest.

- Savings Accounts: Intended for accumulating funds over time, typically offering interest on deposits. Suitable for short-term goals or emergency funds.

- Money Market Accounts: Blend features of checking and savings accounts, offering higher interest rates than traditional savings accounts. It may have minimum balance requirements.

- Certificates of Deposit (CDs): Time-based deposit accounts with fixed interest rates for a specified term. Higher interest rates compared to savings accounts but require locking in funds for the duration.

What Is A Checking Account? – Your Guide To Everyday Banking!

A checking account is a type of bank account that allows you to deposit, withdraw, and manage your funds for everyday financial transactions.

It serves as a hub for managing your money, providing convenient access to funds through various channels such as checks, debit cards, and online banking.

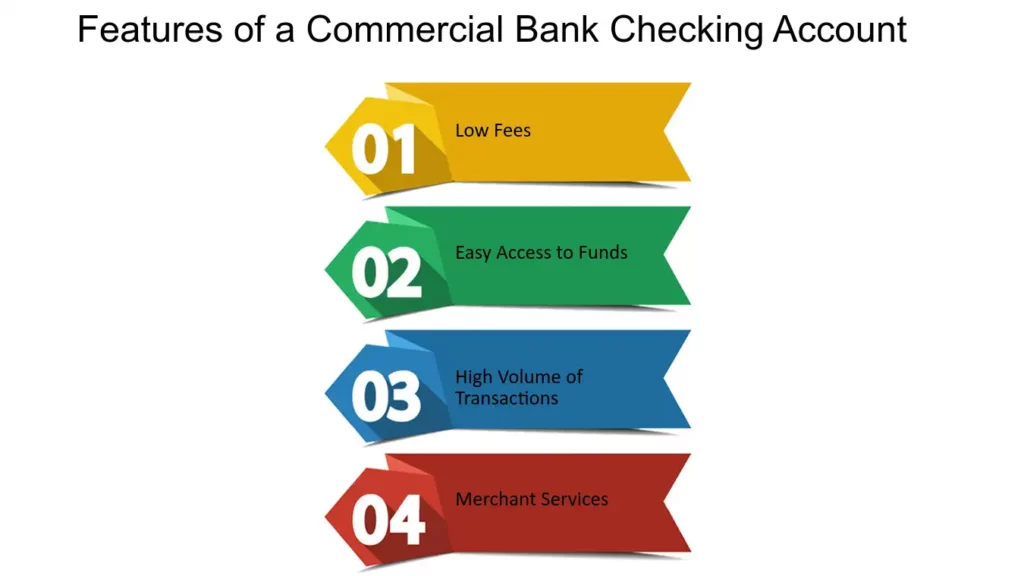

Features Of Checking Accounts:

- Deposits: You can deposit money into your checking account through various methods, including direct deposit, ATM deposits, mobile check deposits, or in-person at a bank branch.

- Withdrawals: Checking accounts allow you to withdraw funds as needed, either by writing checks, using a debit card for purchases, or withdrawing cash from ATMs.

- Check Writing: One of the traditional features of checking accounts is the ability to write checks to pay bills or make purchases. When you write a check, you’re instructing your bank to pay the specified amount to the recipient.

- Debit Card Usage: Most checking accounts come with a debit card, which allows you to make purchases directly from your account funds, similar to using cash.

- Online Banking: Many banks offer online banking services for checking accounts, allowing you to manage your account, view transactions, pay bills, and transfer funds electronically.

Interest Rates On Checking Accounts:

Checking accounts are primarily transactional accounts meant for managing day-to-day expenses rather than accumulating savings. As such, most checking accounts do not offer any interest on deposited funds.

While some banks may offer minimal interest on checking account balances, the rates are typically lower compared to savings accounts or other interest-bearing accounts.

Pros And Cons Of Checking Accounts:

1. Pros:

- Convenience: Checking accounts provide convenient access to your funds, allowing you to make purchases, pay bills, and withdraw cash easily.

- Flexibility: You can use a checking account for various financial transactions, from paying rent and utilities to buying groceries or dining out.

- Safety: Keeping your money in a checking account is generally safer than carrying cash, as funds are protected by FDIC insurance (up to the maximum allowable limit).

2. Cons:

- Low or No Interest: Checking accounts usually offer minimal or no interest on deposited funds, which means your money may not grow significantly over time.

- Fees: Some checking accounts may come with fees, such as monthly maintenance fees or overdraft fees, depending on the bank and account type.

- Limited Savings Potential: While checking accounts are suitable for managing everyday expenses, they are not ideal for long-term savings goals due to the lack of substantial interest earnings.

Choosing the Right Checking Account

When selecting a checking account, consider factors such as fees, minimum balance requirements, ATM access, online banking features, and overdraft protection options. Compare offerings from different banks to find an account that aligns with your financial needs and preferences.

Savings Accounts – A Guide to Growing Your Money!

Saving money is important, and savings accounts are a great way to do it. These accounts help your money grow over time by giving you extra money called “interest.” Let’s break down what savings accounts are all about in easy words:

What Savings Accounts Do:

- Earn Extra Money: When you put your money in a savings account, the bank gives you extra money on top of what you already have. This extra money is called “interest,” and it helps your savings grow faster.

- Easy Access: Even though it’s called a savings account, you can still get to your money whenever you need it. You can take money out from an ATM, transfer it online, or go to the bank in person. But there are some rules about how many times you can take money out each month.

- Safe Place for Your Money: Your money is safe in a savings account. If the bank ever has problems, the government will make sure you don’t lose your money, up to a certain amount.

Sometimes, You Need to Keep a Minimum: Some savings accounts ask you to keep a certain amount of money in them. This helps you avoid paying extra fees.

Certificates of Deposit (CDs) – A Secure Investment Option:

Certificates of Deposit, or CDs, are a safe and simple way to earn more money with your savings. When you put your money into a CD, you agree to leave it in the bank for a set amount of time, which can be a few months or a few years.

In return, the bank promises to pay you back your initial deposit plus extra money called interest when the CD matures.

1. How CDs Work

CDs have a fixed interest rate, which means it stays the same for the whole time you have the CD. This makes it easy to know how much money you’ll make. The longer you leave your money in the CD, the more interest you’ll earn.

2. Fixed Interest Rates

Unlike other types of savings accounts where the interest rate can change, CDs have a fixed rate, so you always know what to expect. This makes CDs a predictable and safe way to grow your money.

3. Terms and Penalties

CDs come in different lengths, called terms. If you take your money out of a CD before the term is up, you might have to pay a penalty. It’s important to understand the rules before you decide to open a CD.

Frequently Asked Questions:

1. Do checking accounts ever offer interest?

While it’s rare, some checking accounts may offer minimal interest on deposited funds. However, the interest rates are usually significantly lower than what you’d find with savings accounts or other investment options.

2. How can I maximize interest earnings on my bank accounts?

To maximize interest earnings on your bank accounts, consider opting for high-yield savings accounts or money market accounts that offer competitive interest rates.

3. Are there any risks associated with keeping money in bank accounts that offer low or no interest?

While bank accounts with low or no interest generally pose minimal risk to your deposited funds, it’s essential to consider inflation and purchasing power erosion over time. Inflation can erode the value of your money, potentially outweighing any nominal interest earnings.

Conclusion:

When it comes to choosing a bank account, it’s crucial to understand the different types available and their respective features, including interest rates. While checking accounts typically offer the least, if any, interest, savings accounts, money market accounts, and certificates of deposit provide opportunities to grow your money over time.

Read More: